What are FICO scores and how do they impact you financially?

Do you know what a FICO score is? If not, don’t worry because you’re not alone. A FICO score is a credit scoring model used by lenders to determine your creditworthiness and likelihood of paying back loans or lines of credit. It’s essentially a summary of your financial history, including how much debt you have and whether or not you consistently pay bills on time. In this blog post, we’ll dive deeper into what FICO scores are all about and explore how they can impact your finances in both positive and negative ways. Whether you’re looking to improve your credit score or simply want to understand the basics, keep reading!

What is a FICO score?

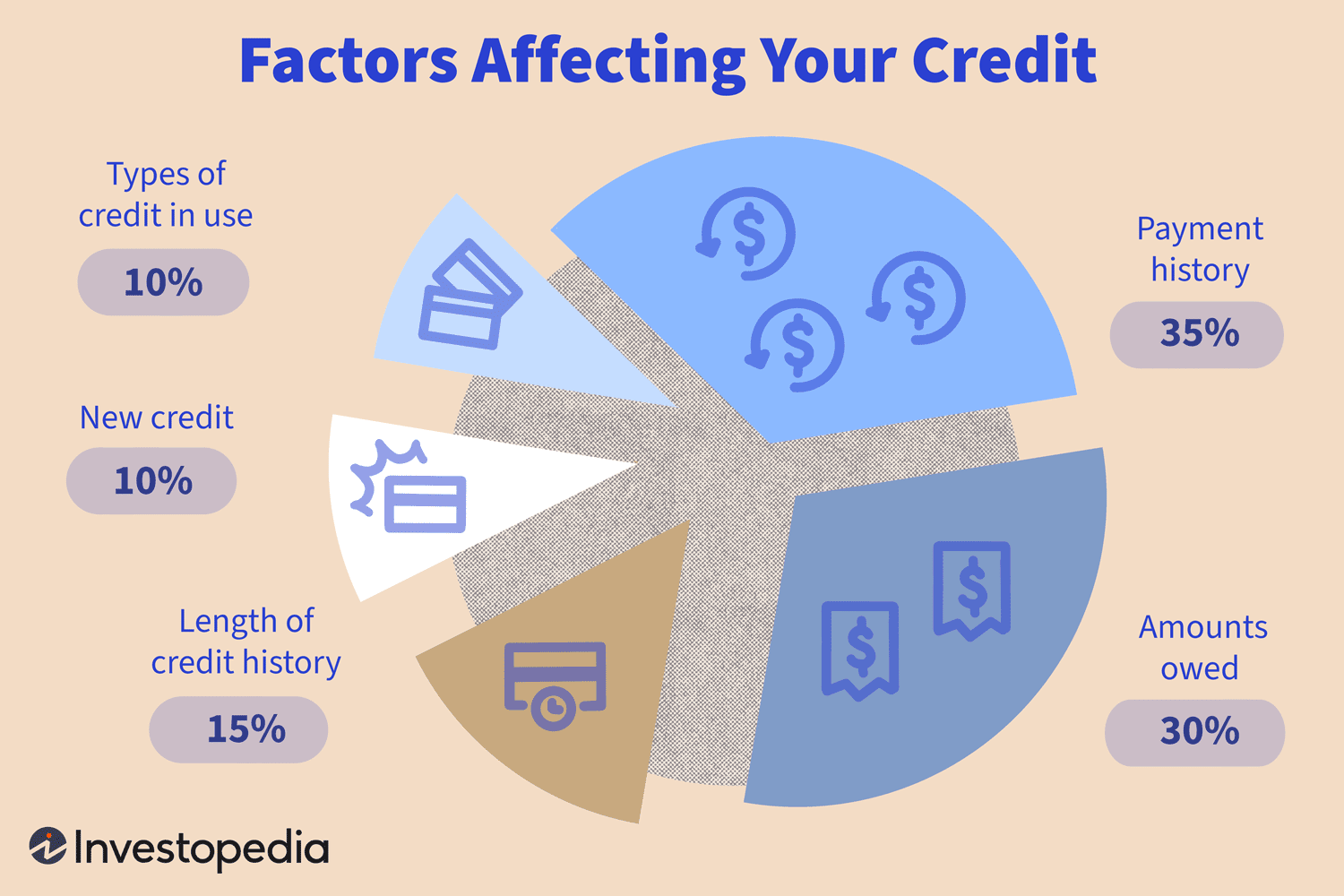

A FICO score is a credit scoring model that’s used to determine your creditworthiness. It’s named after the company that created it: Fair Isaac Corporation. This three-digit number ranges from 300 to 850 and is based on various factors such as payment history, amounts owed, length of credit history, types of credits used, and new credit applications.

Your FICO score can have a significant impact on your financial life since it affects things like interest rates for loans or lines of credit. A high score indicates that you’re responsible with money and are more likely to pay back borrowed funds on time. However, a low score can make it challenging to secure loans or qualify for good terms on existing debt.

It’s important to note that there are different types of FICO scores depending on what type of loan or line of credit you’re applying for. For example, the scores required for mortgages may differ from those needed for auto loans or personal lines of credit.

Understanding what a FICO score represents can help you improve your finances by setting goals towards building and maintaining strong financial habits over time.

How do FICO scores work?

FICO scores are a three-digit number that ranges from 300 to 850, indicating your creditworthiness. The higher the score, the better your credit is. FICO scores are calculated based on several factors such as payment history, amounts owed, length of credit history, new credit accounts and types of credits used.

Payment history contributes significantly to your FICO score. It shows whether you have paid all your bills on time or if you have any delinquent payments. Late payments can reduce your score drastically.

The amount owed also affects your FICO score since it indicates how much debt you carry relative to your available credit limits. Having high balances can negatively impact your score.

The length of credit history is another factor considered in calculating FICO scores. A longer track record of responsible borrowing behavior increases chances for a higher score.

Opening too many new accounts at once may suggest financial instability which could lower one’s FICO score over time.

FICO scores consider various types of credits including installment loans like car and student loans compared to revolving debts like credit cards which might also affect their scores differently.