What is the one rule for a person to build a strong financial foundation?

Are you looking to build a strong financial foundation but don’t know where to start? It can be overwhelming, with so much advice out there. But fear not! There is one rule that can set you on the right path towards financial stability and success. In this blog post, we will reveal the golden rule for building a solid financial foundation and show you how to follow it step-by-step. The best part? Once you begin implementing this rule, you’ll reap numerous benefits that will positively impact your life in ways beyond just your finances. So let’s dive in!

The Rule

The rule for building a strong financial foundation is simple: spend less than you earn. It may seem obvious, but it’s surprising how many people struggle with this basic principle. To follow the rule, start by tracking your income and expenses. This will help you identify areas where you can cut back on spending.

Next, create a budget that outlines your monthly income and expenses. Be sure to allocate money for savings and investments as well. Stick to your budget as closely as possible each month, making adjustments as necessary.

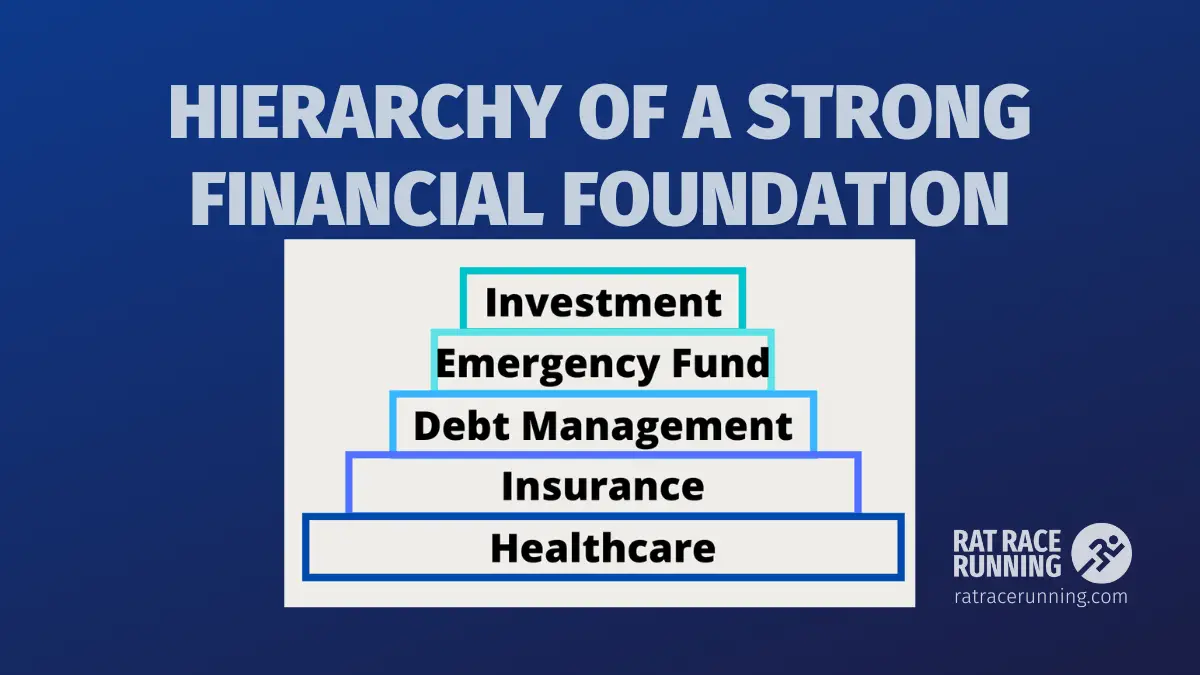

If you’re carrying debt, focus on paying it down aggressively while also saving for emergencies and future goals. Once your debt is paid off, continue to save and invest wisely to build wealth over time.

Remember that following the rule doesn’t mean living frugally or sacrificing everything you enjoy in life. It simply means being mindful of your spending habits and prioritizing long-term financial stability over short-term gratification.

By consistently following this one rule, you’ll be able to build a solid financial foundation that will serve you well throughout your life.

How to follow the Rule

Now that we have discussed the one rule for building a strong financial foundation, let’s talk about how to follow it. The key is to start early and be consistent. Begin by creating a budget and tracking your expenses to ensure you’re living within your means. This will help you avoid overspending and accumulating debt.

Next, prioritize saving for emergencies and retirement. Set up automatic transfers from your checking account into an emergency fund and retirement accounts like 401(k)s or IRAs. Aim to save at least three months’ worth of expenses in your emergency fund before focusing on other goals.

When it comes to investing, keep it simple by diversifying your portfolio across different asset classes like stocks, bonds, and real estate. Consider working with a financial advisor who can guide you through the process if needed.

Another important aspect of following the rule is staying informed about personal finance topics such as taxes, insurance, and credit scores. Make time each month to review your finances and adjust as necessary.

Remember that following this rule takes discipline but can lead to significant long-term benefits such as financial security and freedom. Stay committed to the process even when faced with obstacles or setbacks along the way.