Why is it recommended that you begin to save early for retirement?

Are you in your 20s or 30s and think it’s too early to start saving for retirement? Think again! Starting early is the key to a comfortable retirement. In this blog post, we’ll explain why starting early is so important and how it can benefit you in the long run. From compound interest to rising costs of living, we’ll cover all the reasons why it’s recommended that you begin to save for retirement as soon as possible. So grab a cup of coffee and let’s get started!

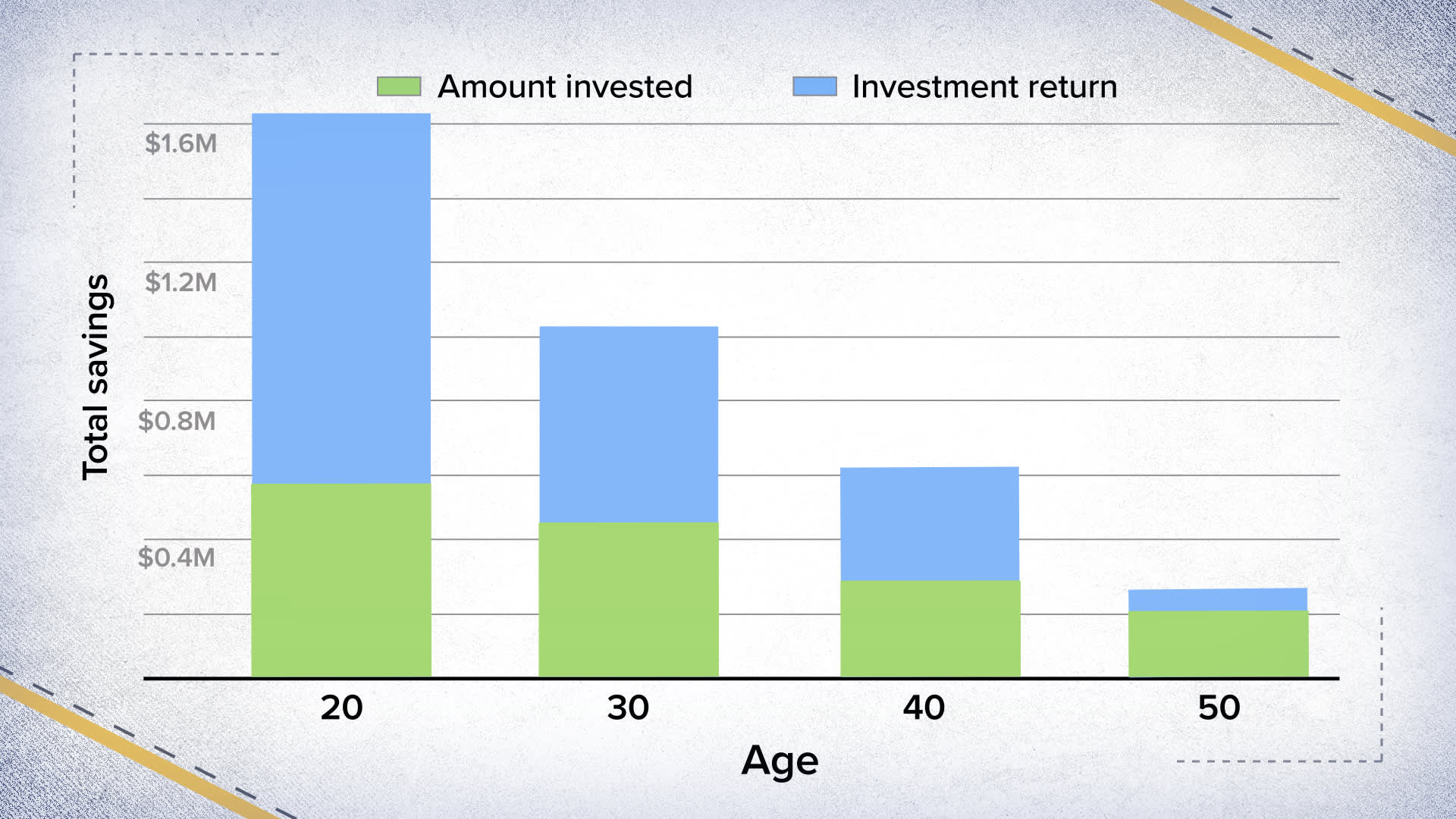

The earlier you start saving, the more time your money has to grow

When it comes to saving for retirement, time is your best friend. The earlier you start saving, the more time your money has to grow. This means that even small contributions can make a significant impact in the long run.

Let’s say you start saving $100 per month at age 25 and continue until you’re 65. Assuming an annual return of 7%, your savings will grow to over $300,000 by the time you retire.

On the other hand, if you wait until age 35 to start saving and invest the same amount each month with the same rate of return, your savings will only grow to around $150,000.

The difference between starting at age 25 versus age 35 might not seem like much now but can mean a world of difference once it’s actually time for retirement. So don’t let procrastination take away from potential future security – consider starting early instead!

Compound interest

Compound interest is a powerful tool that can help you grow your retirement savings significantly over time. Put simply, compound interest means earning interest on both the principal amount of money you invest and the accumulated interest from previous periods. This way, your money grows faster than it would with simple interest.

When saving for retirement, aim to start as early as possible in order to take full advantage of compounding. The longer you save and allow your investments to grow through compound interest, the larger your nest egg will be when it’s time to retire.

It’s important to remember that compounding works best over long periods of time – decades rather than just a few years – so starting early gives you more time for this growth process to work its magic.

By investing regularly and reinvesting any dividends or capital gains back into your portfolio instead of taking them out, you can maximize the benefit of compounding and increase your chances of reaching your retirement goals. So if you haven’t started saving yet, now is the perfect time!